crypto tax calculator canada

Exchanges such as Binance also allow you to manually export your trade history. Whether you are filing yourself using a tax software like SimpleTax or working with an accountant.

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances.

. How is crypto tax calculated in Canada. Subscribe to our daily newsletter for the latest and must-read tech news delivered straight to your inbox. Tax on cryptocurrencies or virtual digital assets announced on Tuesday will create more problems for investors and their tax experts on computing gains and taxation.

And what will be its long term and short term impact on the crypto investors and exchanges. Microsoft buys one of the biggest game publishers Mozilla pauses accepting crypto for donations and Ericsson sues Apple over patent infringements. For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto.

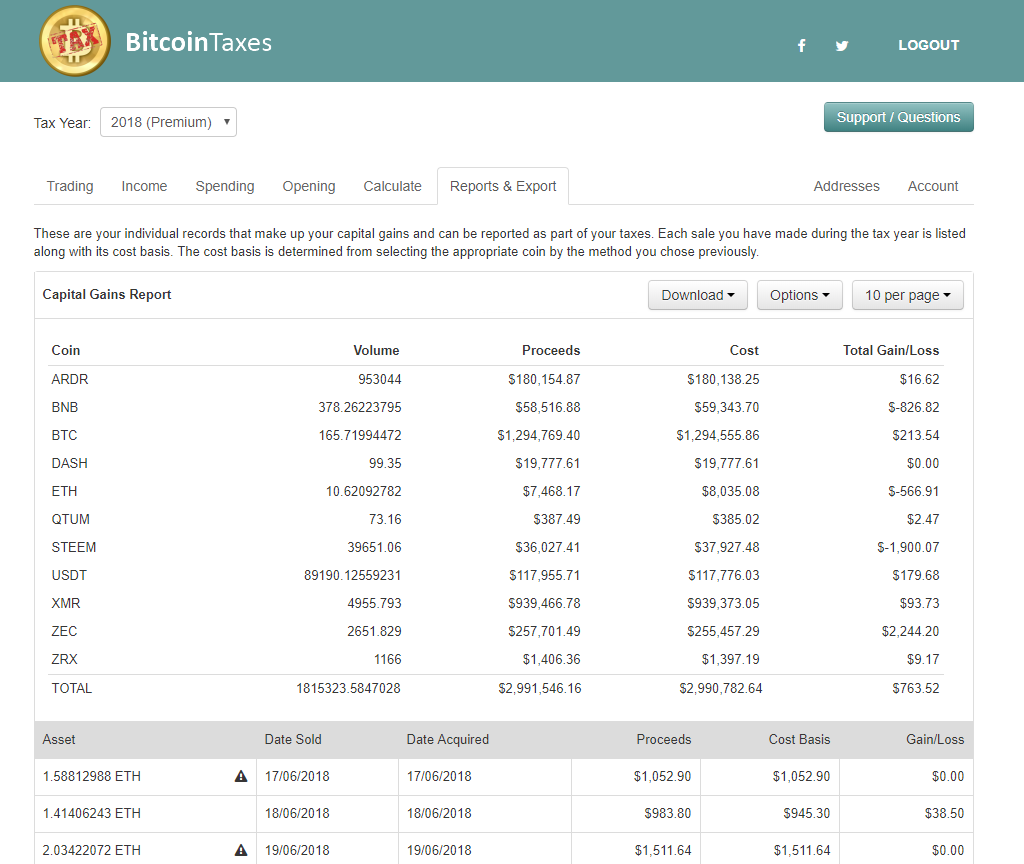

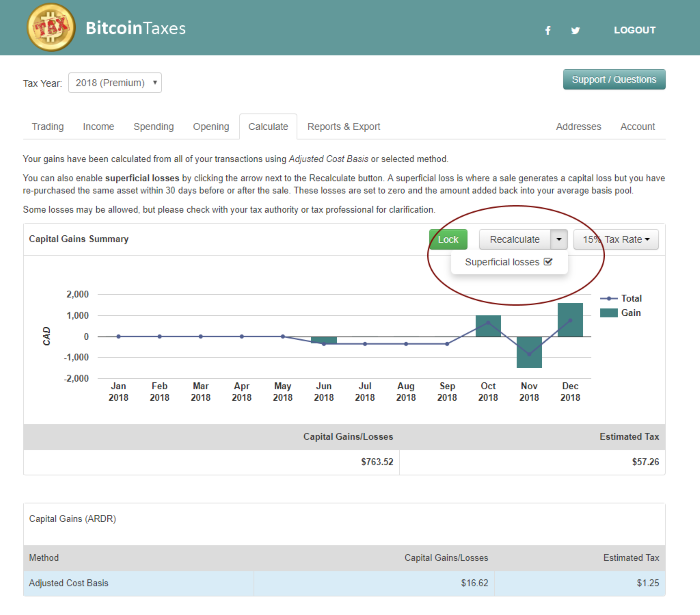

Report crypto on your taxes easily using Koinly a crypto tax calculator and software. 2021 free Alberta income tax calculator to quickly estimate your provincial taxes. Once you have imported your trade history the crypto tax software will compile this and give you a rundown of total capital gains or losses.

Paying taxes on cryptocurrency in Canada doesnt have to be a headache. Crypto Industrys Reaction on Budget 2022 crypto tax budget 2022 budget finance minister nirmala sitharaman crypto bill cryptocurrency Stay on top of technology and startup news that matters. Crypto taxes in Canada are confusing because there are so many use cases for crypto.

Koinly can generate the right tax documents for you. Crypto tax software integrates with your exchanges API to fetch and compile a list of all your transactions. How will it impact your crypto income.

Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2021. You can use crypto as an investment as a currency for spending or as a source of passive income. Some employees are paid with Bitcoin more than a few retailers accept Bitcoin as payment and others hold the e-currency as a capital asset.

Generate a full crypto tax report with all your. Schedule 3 Download your Schedule 3 with pre-filled figures from your crypto trades. So what are the possible issues that new regulations will throw up.

Recently the Internal Revenue Service IRS clarified the tax treatment of virtual currency transactions. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2021. Thats all the tech news thats trending.

2021 free Canada income tax calculator to quickly estimate your provincial taxes. Download your CRA tax documents. Virtual currency like Bitcoin has shifted into the public eye in recent years.

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

Koinly Bitcoin Tax Calculator For Canada

.png)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

Crypto Taxes In Canada Adjusted Cost Base Explained

Crypto Taxation In Canada 2022 Ultimate Guide Ocryptocanada

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax